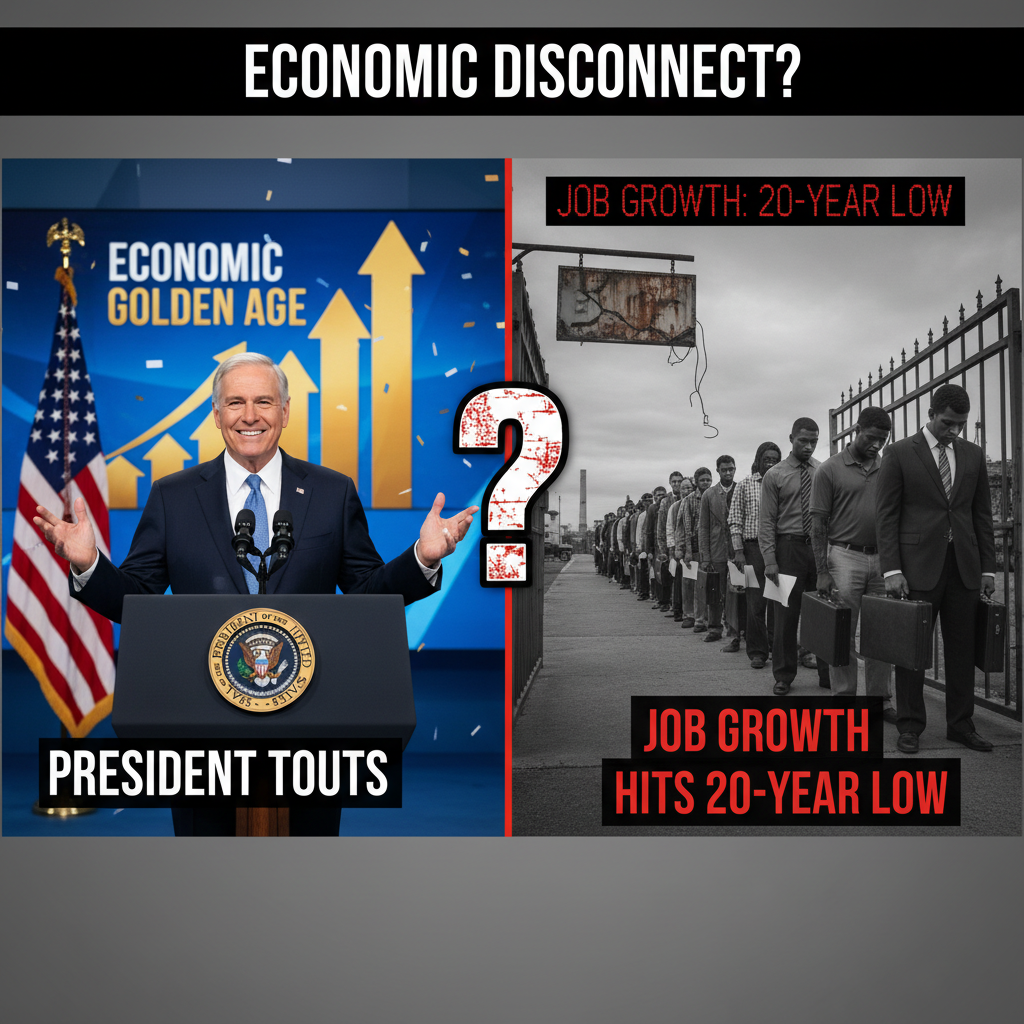

President Touts Economic Golden Age While Job Growth Hits Twenty Year Low

Speaking at the World Economic Forum in Davos this week, President Donald Trump declared a new American economic golden age, yet federal data released simultaneously reveals a complex reality characterized by surging stock markets clashing with the slowest annual job growth in over two decades.

Post-Election Policy Shifts Fuel Global Economic Uncertainty

The administration has pursued aggressive structural changes since taking office in 2025, these include massive federal workforce reductions led by the Department of Government Efficiency. While the previous administration saw job gains exceeding 2 million annually, the shift toward deregulation and tariff-heavy trade strategies has fundamentally altered the labor landscape, this pivot aims to boost domestic manufacturing but has introduced significant volatility into global markets. The current economic divergence draws comparisons to the 2003 era, analysts note that the rapid integration of artificial intelligence and mass deportations are further complicating traditional employment metrics.

Official Statistics Contradict Administration's Inflation and Investment Claims

The Bureau of Economic Analysis reports a robust 4.3% GDP growth rate for the third quarter of 2025, this figure supports the administration's narrative of high-level expansion in energy and technology sectors. However, total job creation for 2025 plummeted to just 584,000 positions, this marks the lowest annual gain since 2003 and stands in stark contrast to the rapid hiring seen in previous years. Furthermore, the President's assertion of having virtually no inflation clashes with the Personal Consumption Expenditures price index, this key metric remains stubbornly above the Federal Reserve target of 2%. Major retailers including Walmart and Best Buy have simultaneously announced price increases, they cite new trade tariffs as the primary driver for rising consumer costs.

Corporate Sector Reactions to Trade Barriers

While the S&P 500 has climbed 13% largely due to corporate tax incentives, the retail sector faces mounting pressure from import levies, companies are struggling to maintain margins without passing costs to buyers. The President claimed nearly $20 trillion in new investments, investigative analysis suggests this figure conflates actual spending with projected capital that has not yet materialized.

Retailers and International Allies Brace for Escalating Trade Tensions

Corporate entities are launching legal challenges against the administration's use of emergency powers, companies like Costco and Revlon have filed lawsuits to block tariffs that they argue bypass Congressional oversight. International relations are similarly strained as European leaders face reciprocal tariffs of up to 25%, these levies are being used as leverage in negotiations concerning the proposed $700 billion acquisition of Greenland. Consumers now face a bifurcated economy, they benefit from lower energy costs but must absorb higher prices for imported goods and services.

Economists warn that the scheduled tariff increases in June 2026 could trigger a broader global contraction, officials urge a resolution before trade barriers further destabilize the recovering supply chain.