Record Payroll and Tucker Deal Ignite Fierce Debate Over Baseball Competitive Balance

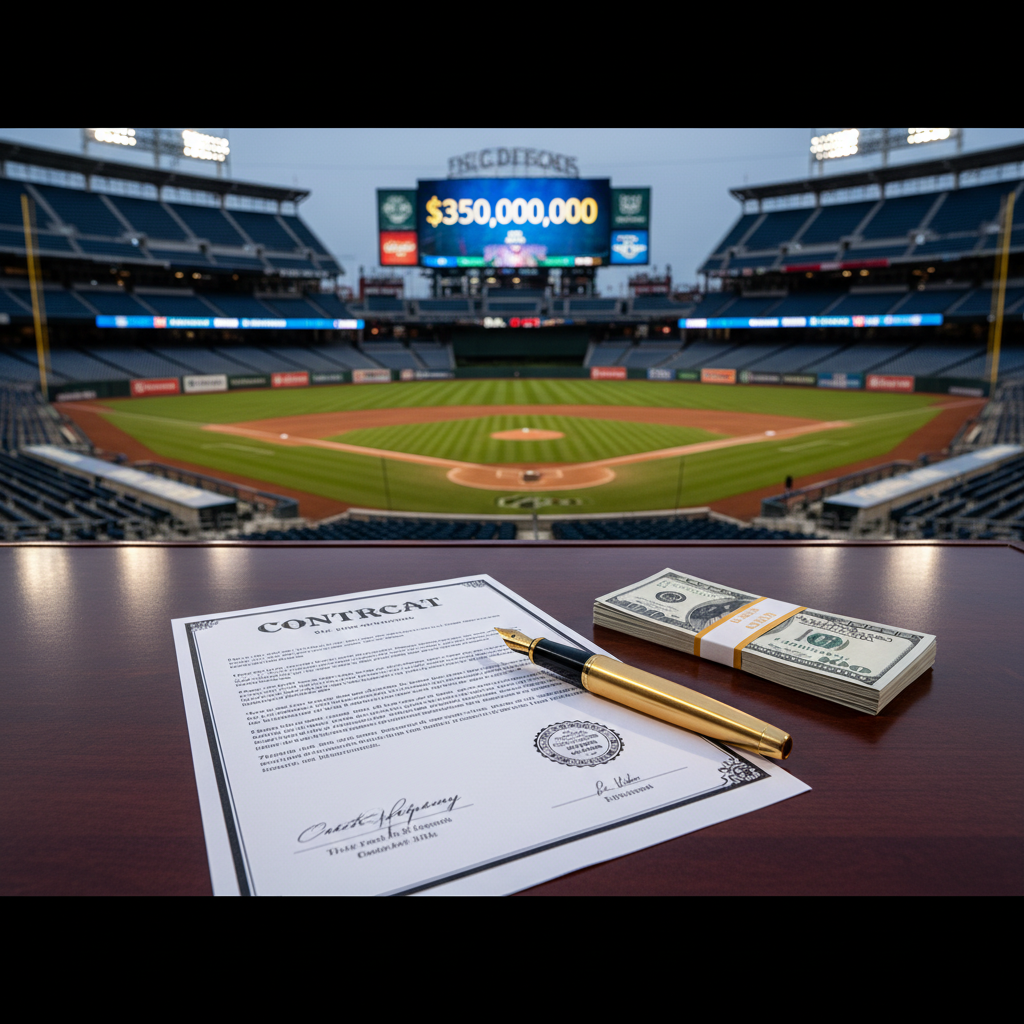

The Los Angeles Dodgers finalized a massive contract for outfielder Kyle Tucker in January 2026, this move has immediately reignited intense arguments regarding financial fairness in professional baseball. The signing pushes the team payroll to historic levels, it prompts questions about the sustainability of current economic rules within the sport.

Historic Spending Spree Creates Unprecedented Financial Gap

The Dodgers secured consecutive World Series championships in 2024 and 2025, their dominance is built upon a foundation of aggressive spending that began years earlier. The organization previously committed over one billion dollars to global icons like Shohei Ohtani and Yoshinobu Yamamoto, this strategy has effectively shattered the intended deterrents of the league luxury tax system. Major League Baseball relies on financial penalties rather than a hard salary cap to control spending, the Dodgers have proven willing to pay these hefty fines to assemble a roster filled with superstars.

Tucker Acquisition Pushes Luxury Tax Bill Past Competitor Payrolls

The arrival of All Star outfielder Kyle Tucker marks the latest escalation in this financial strategy, the four year deal is valued at $240 million. This acquisition lifts the projected 2026 team payroll to roughly $417 million, the figure stands approximately $150 million above the highest taxation threshold set by the league. Management continues to utilize deferred money to manage cash flow, this allows them to keep adding talent despite the penalties.

Tax Implications Reveal Disparity

Estimates suggest the Dodgers will owe approximately $170 million in luxury tax penalties alone, this single tax bill exceeds the entire player payroll of at least 12 other franchises including the Miami Marlins. Critics argue this disparity renders the regular season outcome a foregone conclusion, supporters contend the ownership is simply utilizing resources to win within the existing rules. The sheer scale of spending has drawn comparisons to the New York Yankees dynasties of previous decades, though the current financial gap is even wider.

Upcoming Labor Negotiations Face High Risk of Work Stoppage

Rival team owners are reportedly furious regarding this continued spending spree, they are expected to demand a hard salary cap during the next collective bargaining negotiations. The current labor agreement expires after the 2026 season, analysts view a potential strike or lockout in 2027 as a highly probable outcome. The Major League Baseball Players Association remains firmly opposed to salary caps, they view such limits as artificial restrictions on player earnings.

Fans in smaller markets now question the value of competing against such financial might, the league faces a critical challenge to maintain national interest outside of Los Angeles. Officials must soon decide how to balance the marketing appeal of super teams against the necessity of competitive hope for all 30 franchises.