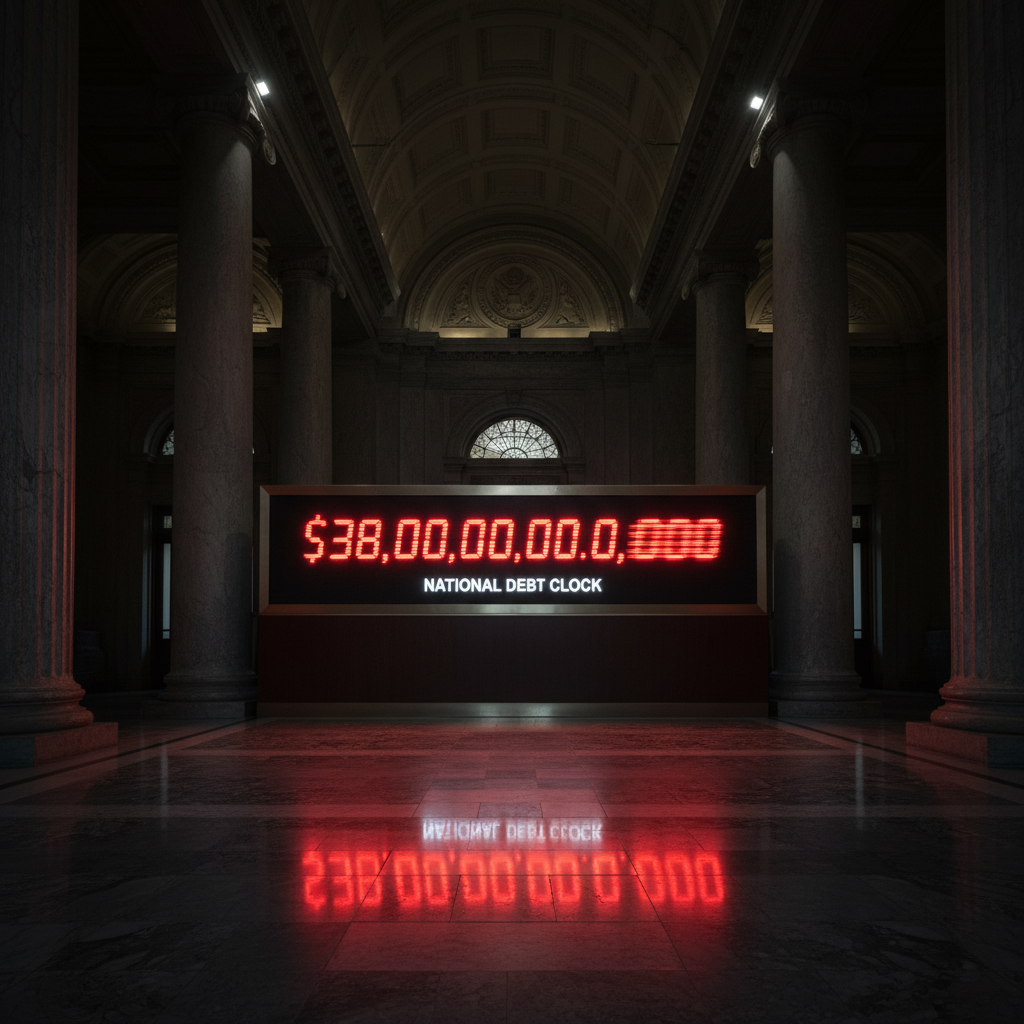

Federal Debt Surpasses $38 Trillion Milestone as Experts Predict Inevitable Economic Crisis

The United States government has officially accumulated over $38.4 trillion in debt as of January 2026, prompting urgent warnings from fiscal watchdogs. Experts believe the nation now faces an unavoidable economic reckoning because federal borrowing costs are growing significantly faster than the economy itself.

Post-War Comparison Highlights Structural Spending Shift

The current financial landscape differs significantly from historical debt spikes. The United States previously managed high debt ratios following World War II by relying on rapid industrial growth to restore balance, yet the current surge creates a different challenge. This accumulation is occurring during a period of relative peace and economic expansion rather than during a global conflict. Structural deficits have persisted for years, this has pushed the International Monetary Fund to warn that American debt levels could soon rival those of Italy or Greece. This trend threatens the dollar's global standing, it suggests that traditional methods of simply growing out of debt may no longer be viable solutions for the federal government.

Interest Obligations Surpass Major Agency Budgets

The most alarming development involves the sheer speed of debt accumulation and the cost to service it. The federal balance sheet added $1 trillion in just 71 days late last year, this rate stands as the fastest non-emergency increase in American history. Fiscal monitors at the Committee for a Responsible Federal Budget note that interest payments alone have exceeded $1.1 trillion annually. This milestone is critical because servicing the national debt now costs taxpayers more than the entire budget for national defense or the Medicare program.

Watchdogs Outline Potential Crisis Scenarios

Experts outline several specific outcomes if the current trajectory continues without intervention. These scenarios range from a sudden financial shock where global investors abandon Treasury bonds to a "gradual crisis" defined by stagnant wages and low productivity. The Congressional Budget Office currently projects that debt held by the public will reach 107% of the total economy by 2029. While some officials argue that new tax policies will stimulate growth, projections indicate these measures could add another $3.4 trillion to the deficit over the next decade.

Households Encounter Higher Costs for Credit

Everyday citizens are beginning to feel the effects of this fiscal imbalance through a phenomenon known as the "crowd-out" effect. Government borrowing competes with the private sector for available funds, this dynamic drives up interest rates for personal mortgages and auto loans. Future generations face a reality where a substantial portion of tax revenue must service past debt rather than funding new infrastructure or social services.

The window to address these structural issues without implementing drastic austerity measures is closing rapidly. Economic officials urge lawmakers to prioritize fiscal sustainability immediately before interest obligations overwhelm the federal budget completely.